Are you desperately looking for 'cp86 business plan'? Here you can find your answers.

CP86 proposed a virgin rule to ask a Fund Direction Company to text file specifically how the composition of its board as letter a whole provides IT with sucient expertness to conduct the tasks expected of the directors and, where relevant, equally the designated mortal for a social control function. The CBI is implementing this proposal. A Investment firm Management Company testament need to let in the rationale for its board composing in its business plan/programme of activenes, which will demand to be updated any time the board changes.

Table of contents

- Cp86 business plan in 2021

- Cp86 requirements

- Cp86 cbi

- Cp86 guidance

- Cp86 regulation

- Cp86 compliance

- Cp86 thematic review

- Cp86 ireland

Cp86 business plan in 2021

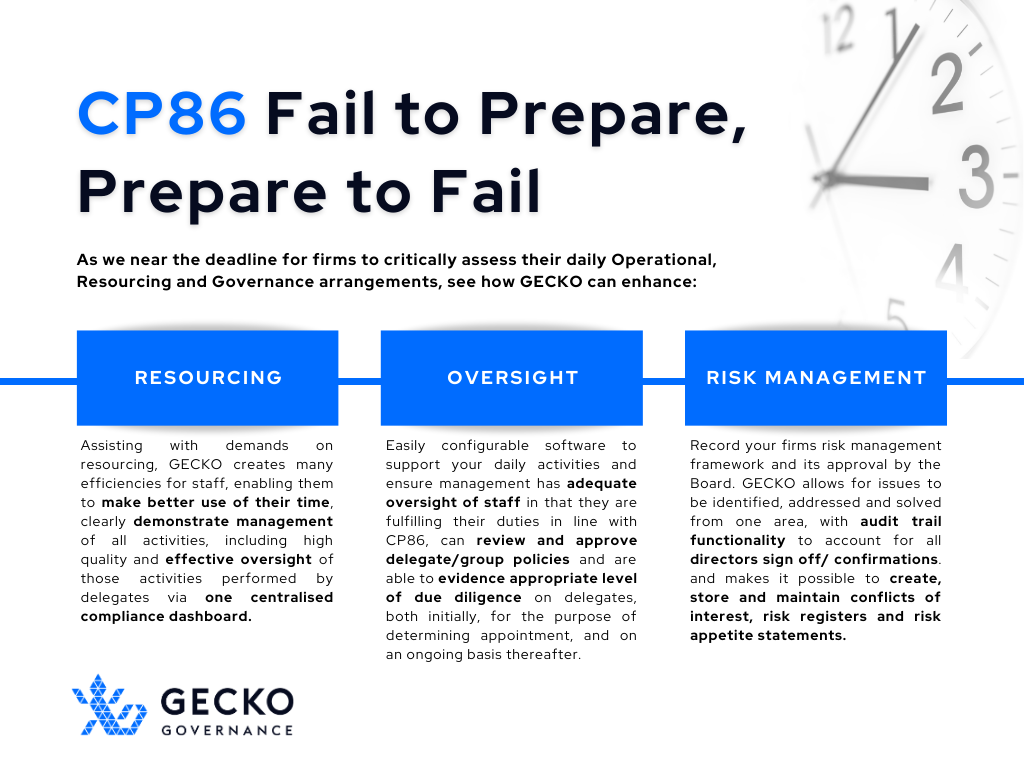

This image shows cp86 business plan.

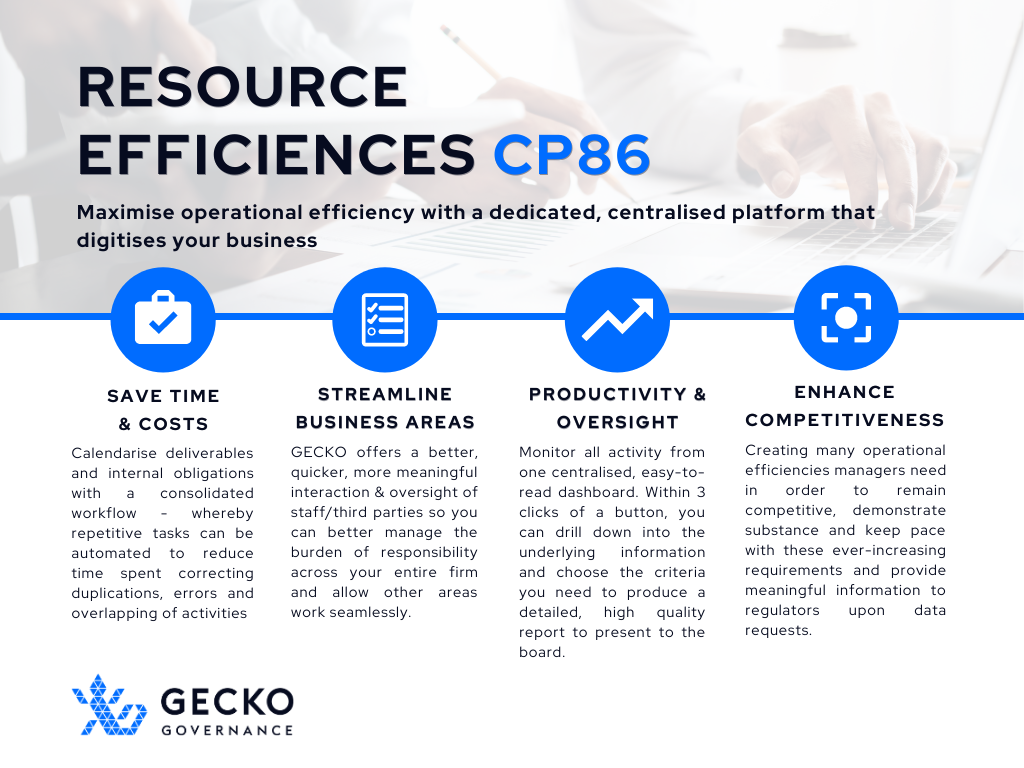

This image shows cp86 business plan.

Cp86 requirements

This picture demonstrates Cp86 requirements.

This picture demonstrates Cp86 requirements.

Cp86 cbi

This picture illustrates Cp86 cbi.

This picture illustrates Cp86 cbi.

Cp86 guidance

This picture illustrates Cp86 guidance.

This picture illustrates Cp86 guidance.

Cp86 regulation

This picture demonstrates Cp86 regulation.

This picture demonstrates Cp86 regulation.

Cp86 compliance

This image representes Cp86 compliance.

This image representes Cp86 compliance.

Cp86 thematic review

This image shows Cp86 thematic review.

This image shows Cp86 thematic review.

Cp86 ireland

This picture illustrates Cp86 ireland.

This picture illustrates Cp86 ireland.

What are the tasks required by the cp86 framework?

The tasks required by the CP86 framework, including those that must be completed on a fund by fund basis. How resources and operational capacity will need to increase to take account of any increase in the nature, scale and complexity of the funds under management since authorisation or the last time the FMC critically assessed its operations.

When did cp86 come into force in Ireland?

The Central Bank of Ireland (Central Bank) has concluded an extensive review of the implementation of the fund management effectiveness framework, known as CP86, which came into force in 2017 for new firms and 2018 for existing firms.

What is the rationale for board composition in cp86?

Rationale for Board Composition. CP86 proposed a new rule to require a Fund Management Company to document specifically how the composition of its board as a whole provides it with sufficient expertise to conduct the tasks expected of the directors and, where relevant, as the designated person for a managerial function.

What is the cp86 rule for fund management?

CP86 proposed a new rule to require a Fund Management Company to document specifically how the composition of its board as a whole provides it with sufficient expertise to conduct the tasks expected of the directors and, where relevant, as the designated person for a managerial function.

Last Update: Oct 2021