Are you asking for 'mcgraw hill connect accounting homework answers chapter 7'? You will find your answers right here.

Table of contents

- Mcgraw hill connect accounting homework answers chapter 7 in 2021

- Financial accounting connect answers

- Connect answer key accounting

- Answers to mcgraw hill accounting

- Mcgraw hill accounting answer key

- Mcgraw hill connect accounting homework answers chapter 7 06

- Mcgraw hill connect accounting homework answers chapter 7 07

- Mcgraw hill connect accounting homework answers chapter 7 08

Mcgraw hill connect accounting homework answers chapter 7 in 2021

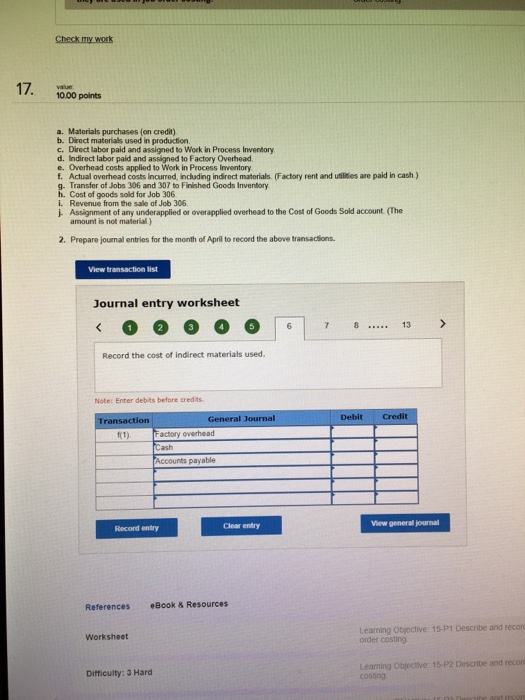

This image representes mcgraw hill connect accounting homework answers chapter 7.

This image representes mcgraw hill connect accounting homework answers chapter 7.

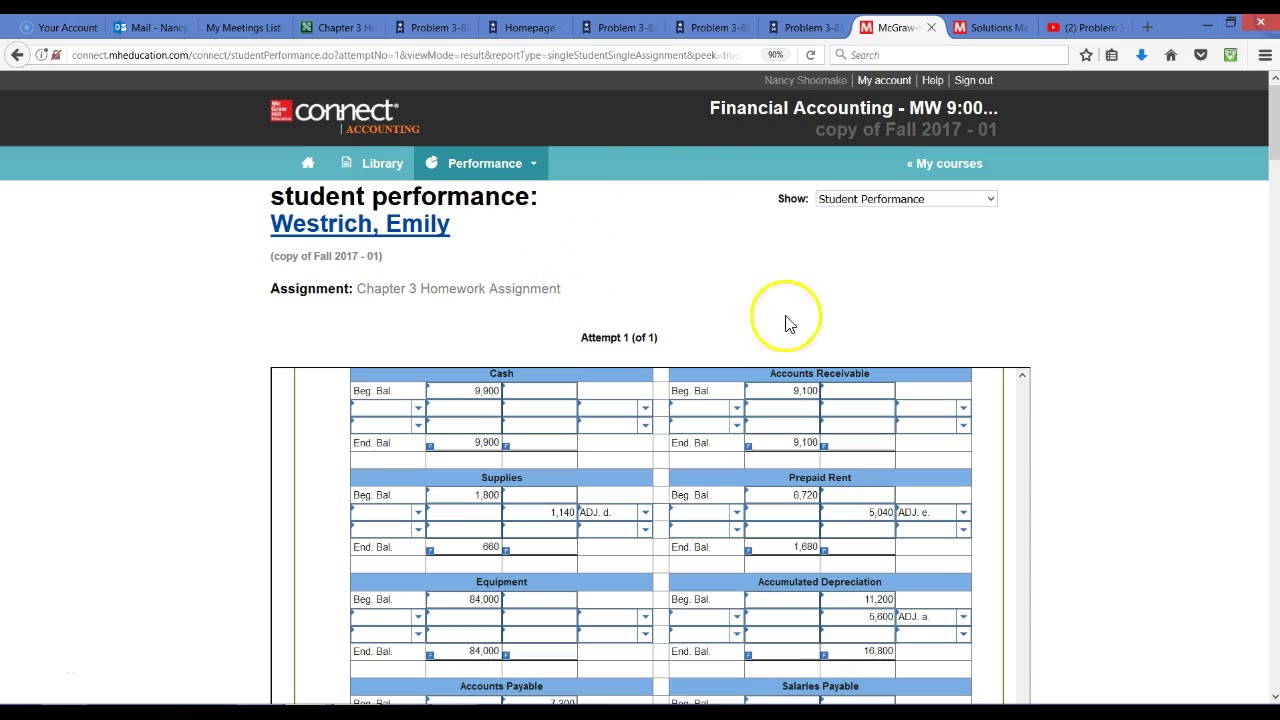

Financial accounting connect answers

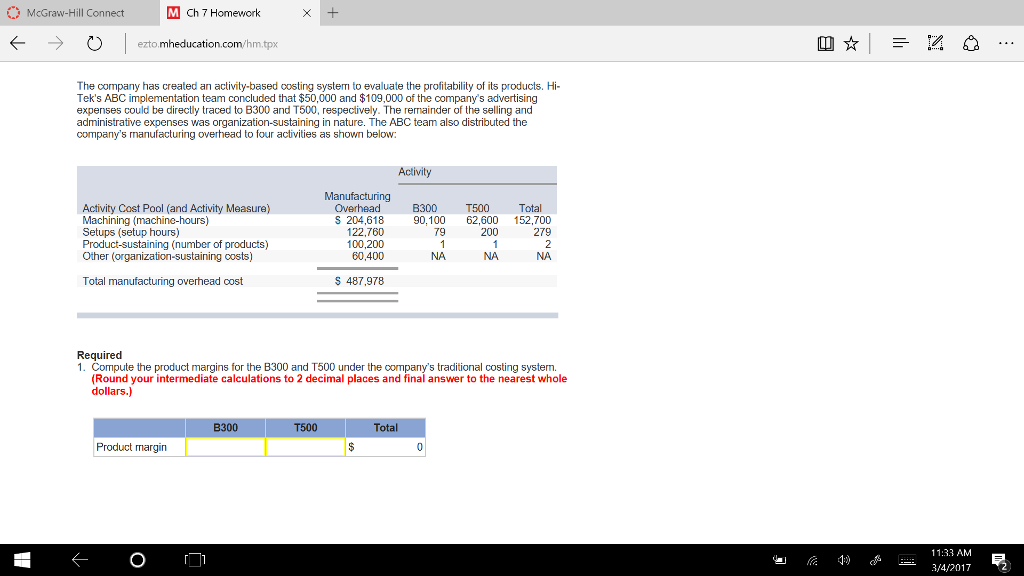

This picture illustrates Financial accounting connect answers.

This picture illustrates Financial accounting connect answers.

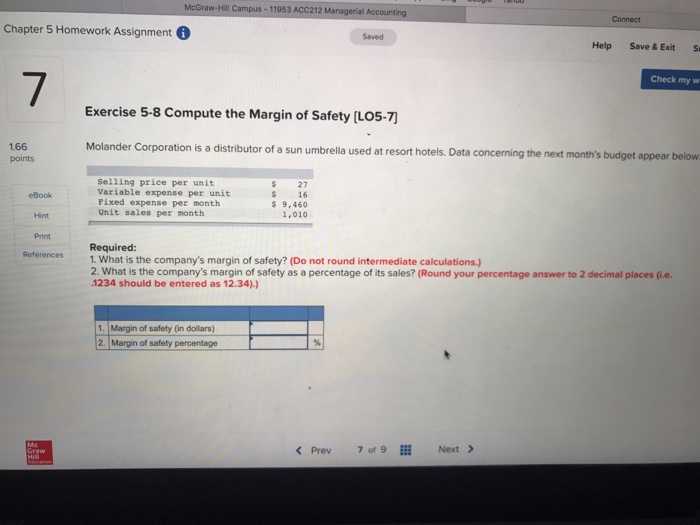

Connect answer key accounting

This picture illustrates Connect answer key accounting.

This picture illustrates Connect answer key accounting.

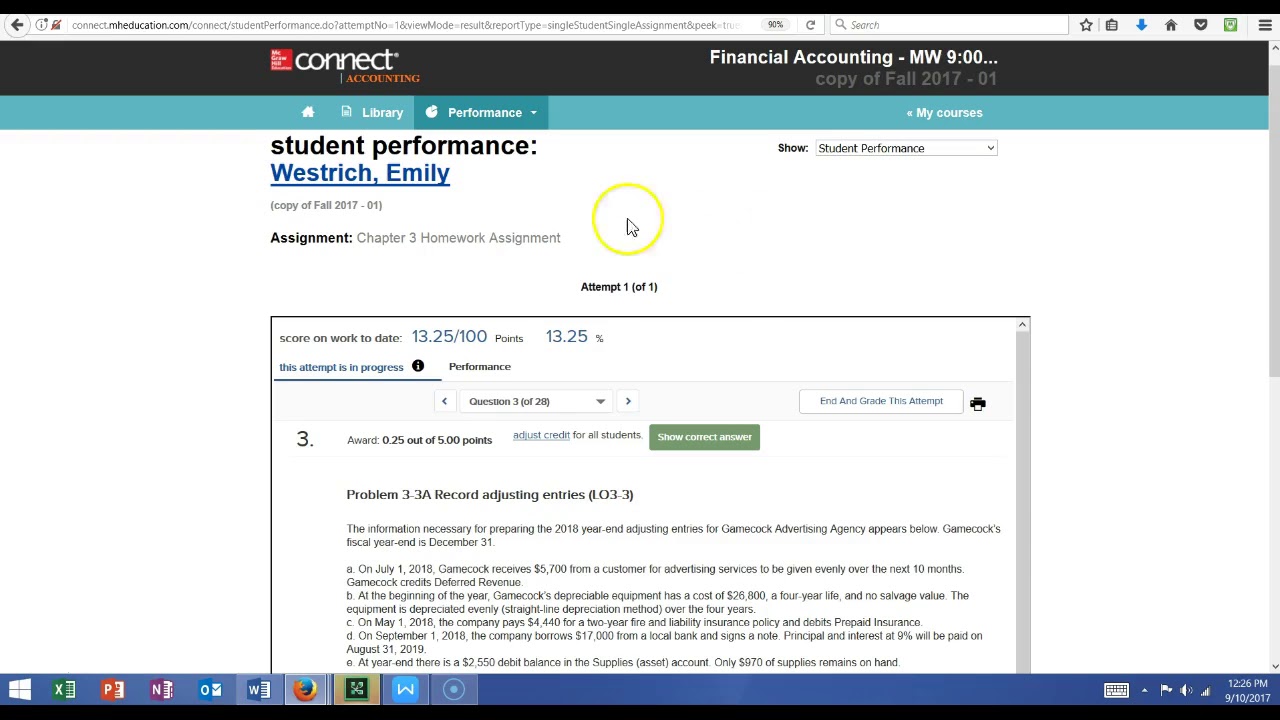

Answers to mcgraw hill accounting

This image demonstrates Answers to mcgraw hill accounting.

This image demonstrates Answers to mcgraw hill accounting.

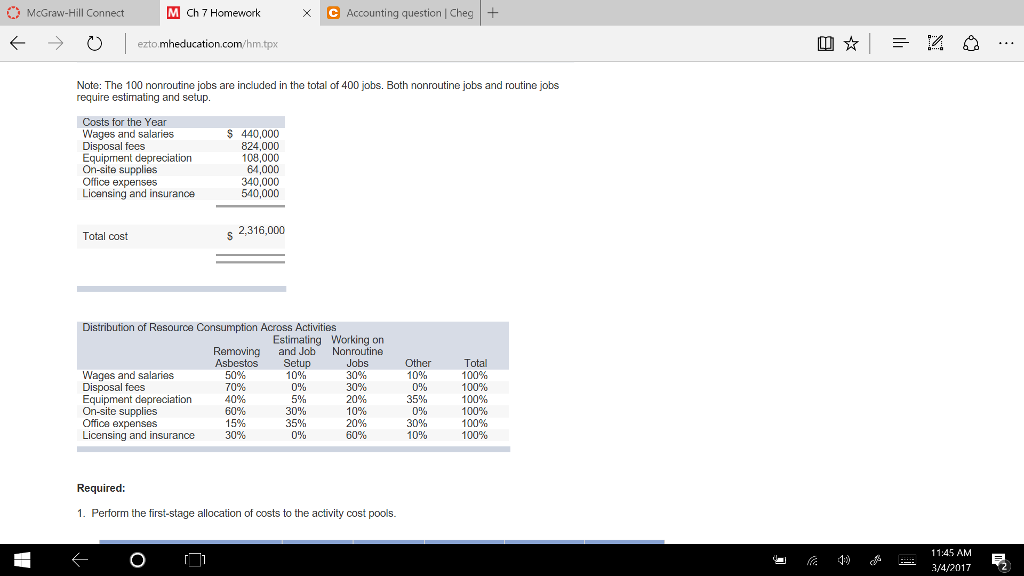

Mcgraw hill accounting answer key

This image demonstrates Mcgraw hill accounting answer key.

This image demonstrates Mcgraw hill accounting answer key.

Mcgraw hill connect accounting homework answers chapter 7 06

This image shows Mcgraw hill connect accounting homework answers chapter 7 06.

This image shows Mcgraw hill connect accounting homework answers chapter 7 06.

Mcgraw hill connect accounting homework answers chapter 7 07

This picture shows Mcgraw hill connect accounting homework answers chapter 7 07.

This picture shows Mcgraw hill connect accounting homework answers chapter 7 07.

Mcgraw hill connect accounting homework answers chapter 7 08

This picture illustrates Mcgraw hill connect accounting homework answers chapter 7 08.

This picture illustrates Mcgraw hill connect accounting homework answers chapter 7 08.

How to calculate tax deductions for McGraw Hill?

Compute his regular pay, overtime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 per week), and gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare portion), income tax deduction, total deductions, and net pay.

How does McGraw Hill connect help with homework?

We at Accounting Assignments Help provide Mcgraw-hill Connect Homework Help and Mcgraw-hill Connect Exam Help with step by step calculation and explanation 24*7 from our professional experts for following topics. Keesha Co. borrows $255,000 cash on November 1, 2017, by signing a 120-day, 11% notes with a face value of $255,000.

When do the McGraw Hill bonds pay interest?

Prepare the journal entries to record the first two interest payments. Hillside issues $2,200,000 of 7%, 15-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $2,692,790.

Last Update: Oct 2021